Should you pay student loans off early is a question on the minds of many borrowers, especially as financial goals evolve and priorities shift. Navigating this decision means weighing both the emotional relief of debt freedom and the strategic moves that might impact your long-term financial health. Whether you’re considering extra payments or just want to know if early payoff is even possible, understanding your options is key to making an informed choice that fits your unique situation.

Paying off student loans ahead of schedule goes beyond just a simple transaction—it shapes your overall financial future. It involves knowing the types of student loans you have, how early payments affect your interest, and what benefits or drawbacks may arise. By exploring the entire process, from understanding your loan terms to strategizing methods for early repayment, you’ll be equipped to determine if this move aligns with your broader financial objectives.

Overview of Paying Student Loans Off Early

Paying student loans off early means making payments that exceed your required monthly minimum, with the goal of eliminating your loan balance before the scheduled end of your repayment term. This strategy can apply to both federal and private student loans, and it can be achieved through regular extra payments, lump sums, or a combination of both.

There are several common types of student loans that borrowers often consider for early repayment. Federal loans, such as Direct Subsidized Loans, Direct Unsubsidized Loans, and PLUS Loans, typically offer flexible repayment terms and borrower protections. Private loans, financed by banks or credit unions, may have higher interest rates and fewer protections but sometimes allow more flexible prepayment options.

The general process for paying off student loans early involves notifying your loan servicer that any extra payments should be applied directly to the principal balance, rather than future payments. This helps reduce the total interest you pay over the life of the loan.

Early repayment refers to the action of paying more than the required minimum payment toward your student loan, with the intention of settling the debt ahead of schedule. By reducing your principal balance faster, you minimize the amount of interest that accrues, potentially saving hundreds or thousands of dollars over the life of the loan.

Potential Benefits of Paying Student Loans Off Early: Should You Pay Student Loans Off Early

Early repayment of student loans can offer significant financial benefits. One of the biggest advantages is the reduction in total interest paid. Since interest is calculated on your remaining principal, making extra payments reduces the balance faster, which means less interest accrues over time.

To illustrate, here’s a comparison of total repayment costs under standard and early repayment scenarios for both federal and private loans:

| Loan Type | Balance | Standard Repayment Total Cost | Early Repayment Total Cost |

|---|---|---|---|

| Federal Direct Unsubsidized | $35,000 | $43,460 | $39,100 |

| Federal PLUS Loan | $25,000 | $32,100 | $29,300 |

| Private Student Loan | $20,000 | $27,800 | $24,900 |

Becoming debt-free sooner can have a profound impact on your overall financial health. It can free up your monthly income for other goals, such as saving for a home, investing for retirement, or starting a business. Psychologically, knowing you are free from student debt can reduce stress and help you feel more in control of your financial future.

Credit utilization is another area that can benefit from early repayment. By lowering your outstanding debt, your debt-to-income and debt-to-credit ratios improve, which can positively influence your credit score over time, making it easier to qualify for favorable rates on other types of loans.

Potential Drawbacks of Paying Student Loans Off Early

While early repayment can be advantageous, it’s not always the best option for every borrower. In some cases, paying off student loans early may not align with your other financial priorities or might even reduce your financial flexibility.

One important consideration is opportunity cost—the potential benefit you forego by choosing one option over another. For example, instead of making extra student loan payments, you might use that money to invest in retirement accounts or other assets that could yield higher returns.

- Investing in a diversified portfolio may yield higher returns (e.g., S&P 500 historical average: 7-8% annually) compared to the interest rate on many student loans (often 4-7%).

- Contributing to an employer-sponsored 401(k) may offer matching funds, essentially providing free money that exceeds what you’d save in student loan interest.

- Building an emergency fund can provide security and prevent costly debt in an unexpected crisis.

Making large payments toward student loans can also impact your liquidity. If you don’t maintain a sufficient emergency fund, you may find yourself in a difficult position if you experience a sudden job loss or medical expense.

With federal student loans specifically, paying off loans early may result in the loss of certain borrower benefits. These can include access to income-driven repayment plans, deferment or forbearance options, or even federal loan forgiveness programs that could reduce or eliminate your debt after a period of qualifying payments.

Factors to Consider Before Early Repayment

Before committing to early repayment, it’s important to evaluate your personal financial situation and weigh the pros and cons. Early repayment often makes sense if you have a stable income, low-interest debt elsewhere, and a strong emergency fund.

The comparison between student loan interest rates and typical investment returns is key. If your loan interest rate is higher than what you could reasonably earn from investing, early repayment may be the smarter choice. However, if investments are likely to outperform your loan interest, it might make sense to invest excess funds instead.

You should also review your loan terms to check for any prepayment penalties or restrictions, especially for private loans, as some lenders might charge fees for early payoff.

Below is a table summarizing key factors to weigh:

| Factor | Description | Benefit | Risk |

|---|---|---|---|

| Interest Rate | Compare loan rate vs. investment returns | Higher savings if loan rate exceeds investment returns | Potential missed investment gains |

| Emergency Fund | Cash available for unexpected expenses | Ensures financial stability | Low fund may increase financial stress if emergencies arise |

| Loan Benefits | Eligibility for federal protections | Access to forgiveness, deferment, flexible repayment | Lose protections after paying off loan |

| Prepayment Penalties | Fees charged for early payoff (mainly in private loans) | None if no penalties | Unexpected costs reduce overall savings |

Methods for Paying Student Loans Off Early

There are various strategies you can use to pay down your student loans faster. Choosing the right method depends on your financial goals, income, and loan types.

Below is a list of popular strategies for early repayment, each with its own context and benefits:

- Making biweekly payments instead of monthly, essentially leading to one extra full payment per year.

- Applying windfalls, such as tax refunds, bonuses, or gifts, directly to your loan balance.

- Increasing your monthly payment by a fixed amount to accelerate payoff.

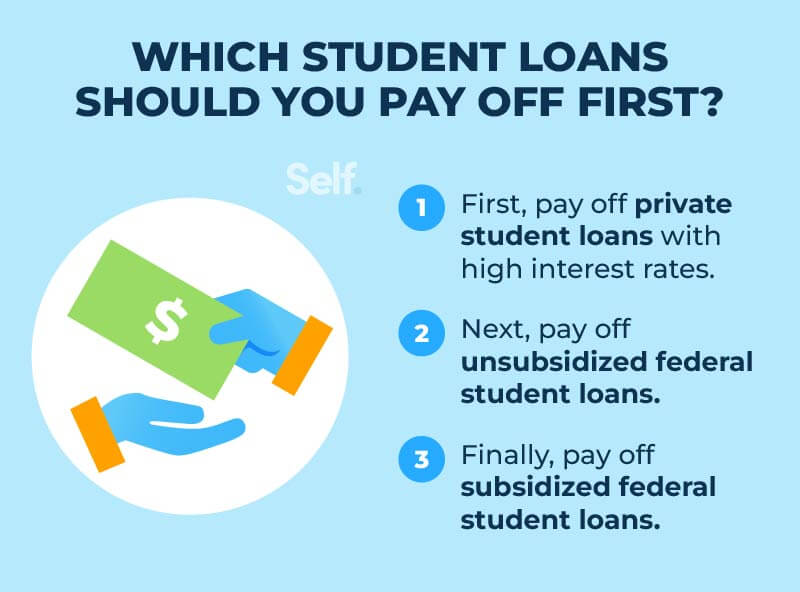

- Prioritizing higher-interest loans first (the avalanche method) to save the most in interest over time.

- Automating extra payments to stay consistent and avoid missed opportunities.

To prioritize high-interest loans, consider this step-by-step procedure:

- List all your student loans, including balances and interest rates.

- Identify the loan with the highest interest rate (regardless of balance).

- Continue making minimum payments on all loans.

- Apply any extra payments to the highest-interest loan until it is paid off.

- Once the highest-interest loan is paid, redirect extra payments to the next highest rate loan, and repeat.

The following table Artikels various methods for early repayment, who they are best for, and examples:

| Method | Description | Best For | Example |

|---|---|---|---|

| Biweekly Payments | Split monthly payment in half, pay every two weeks | Salaried employees with predictable income | Paying $200 every two weeks instead of $400 monthly |

| Windfall Payments | Apply lump sums to loan as they come | Anyone receiving irregular large payments | Using a $1,200 tax refund to pay down loans |

| Increased Monthly Payments | Add a fixed amount to monthly payment | Borrowers with surplus monthly income | Paying $100 above the minimum each month |

| Avalanche Method | Target the highest-interest loan first | Borrowers with multiple loans and varying rates | Paying off a 7.5% loan before a 5% loan |

Automated payments can be particularly helpful for maintaining consistency. Many loan servicers allow you to set up automatic withdrawals for both your minimum and additional payments, reducing the risk of forgetting and helping you stay on track to reach your early payoff goals.

Illustrative Example Scenarios

Seeing how different borrowers approach early repayment can help you visualize how the strategy might apply to your own situation. Below are a few detailed case studies:

Case Study 1: Recent Graduate with Moderate Income

Sarah graduated with $28,000 in federal student loans at a 5.2% interest rate. She landed a steady job earning $50,000 a year and decided to make an extra $100 payment each month in addition to her required minimum. As a result, she paid off her loans in just under 8 years, saving over $2,300 in interest versus the standard 10-year term. Sarah reported feeling a significant sense of relief as her debt balance quickly shrank, allowing her to start saving for a down payment on a home.

Case Study 2: High-Income Professional with Private Loans

James had $60,000 in private student loans at an average interest rate of 7.9%. After receiving a promotion, his income rose to $95,000 annually. He devoted work bonuses and tax refunds to his loan, making two lump-sum payments of $5,000 each in his second and third year out of school. By year six, James had paid off his student debt completely, saving nearly $8,400 in interest. He found the financial freedom enabled him to invest aggressively for retirement.

Case Study 3: Lower-Income Borrower Balancing Multiple Goals

Angela owed $15,000 in federal student loans and worked in a public service job with a modest salary. She opted for an income-driven repayment plan to keep her payments manageable while building an emergency fund. Instead of early repayment, Angela focused on qualifying for Public Service Loan Forgiveness (PSLF). This approach let her maintain financial security and ultimately saw her remaining balance forgiven after 10 years of qualifying payments.

Comparing these scenarios highlights that early repayment can be especially rewarding for those with higher incomes or fewer competing financial priorities, while others may benefit more from leveraging federal loan benefits. Emotionally, borrowers often report a boost in confidence and decreased anxiety as their balances shrink, which can positively influence other areas of life and financial decision-making.

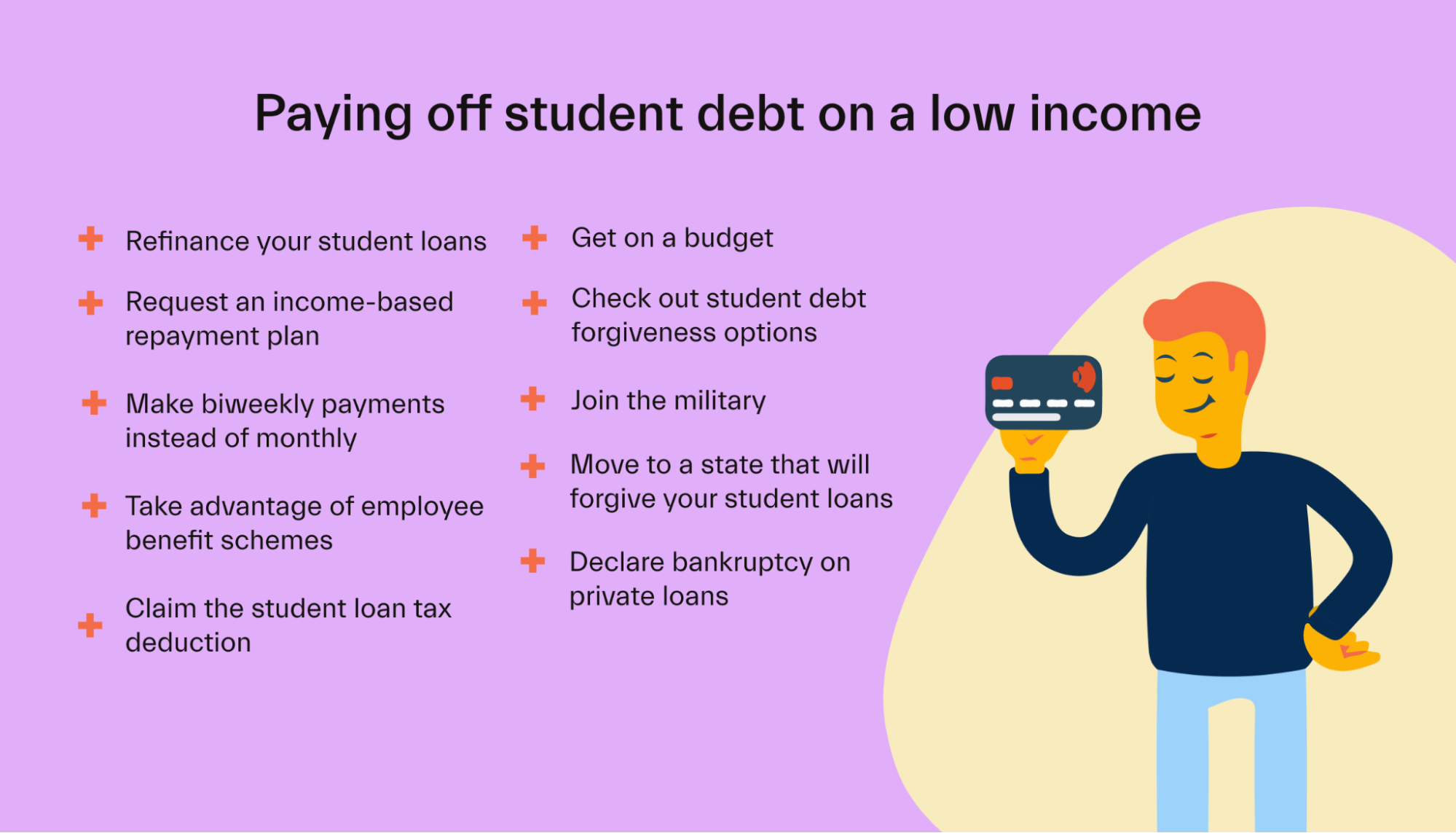

Alternatives to Paying Student Loans Off Early

If early repayment isn’t the best fit for your situation, there are several alternative approaches to managing student loan debt. Each has unique advantages and drawbacks that are important to understand.

- Refinancing to secure a lower interest rate and monthly payment.

- Consolidating multiple federal loans into a single Direct Consolidation Loan for simplified management.

- Enrolling in income-driven repayment plans to cap monthly payments based on your earnings.

- Seeking federal loan forgiveness programs such as PSLF or Teacher Loan Forgiveness.

- Choosing graduated or extended repayment plans to lower payments in the short term.

The table below summarizes these alternatives:

| Alternative | How It Works | Benefits | Considerations |

|---|---|---|---|

| Refinancing | Replace existing loans with a private loan at a lower rate | Potentially lower monthly payments and total interest | Loss of federal protections and forgiveness options; requires good credit |

| Consolidation | Combine multiple federal loans into one | Easier management, fixed interest rate | May reset forgiveness clock, could increase interest paid over time |

| Income-Driven Repayment | Monthly payments based on income and family size | Affordable payments, possible forgiveness after 20-25 years | Interest accrues longer, may pay more over time |

| Forgiveness Programs | Forgive balance after qualifying payments and service | Potential for complete discharge of remaining debt | Strict requirements and documentation, limited to qualifying borrowers |

Each alternative affects long-term financial health differently. Refinancing can reduce costs for those with strong credit but eliminates federal benefits. Income-driven plans and forgiveness programs can provide relief for those with lower income or public service careers, but may result in higher total interest costs.

Tips to Maximize the Benefits of Early Repayment

Maximizing early repayment benefits requires careful planning and attention to detail. Avoiding common mistakes and staying organized can help you get the most out of your efforts.

When making extra payments, it’s crucial to communicate with your loan servicer so that additional amounts are applied toward your principal, not just future payments. This ensures you actually reduce your balance and save on interest.

Budgeting effectively can increase your capacity for extra payments. Consider these tips:

- Track your monthly expenses to identify areas where you can cut back.

- Set a specific, realistic extra payment goal each month.

- Automate transfers to your loan servicer as soon as you receive your paycheck.

- Apply any unexpected income directly to your loan balance.

Documenting all payments and regularly monitoring loan statements is also essential. By keeping detailed records, you can quickly catch errors and ensure that every dollar you send goes toward reducing your balance. This level of diligence not only protects your investment in early repayment, but also helps you remain motivated as you watch your progress unfold.

Wrap-Up

Ultimately, deciding should you pay student loans off early is about finding the right balance for your financial landscape. By carefully considering the potential benefits, such as saving on interest and gaining peace of mind, alongside the possible drawbacks like opportunity costs and lost federal protections, you can chart a path that serves your goals. No matter which direction you choose, being proactive and informed ensures you’re making the smartest move for your future.

Frequently Asked Questions

Will paying off student loans early hurt my credit score?

Paying off your student loans early typically does not hurt your credit score. In fact, it may help by lowering your overall debt and improving your credit utilization. However, your score might temporarily dip if you close a longstanding account, but this effect is usually minor.

Are there penalties for paying off student loans early?

Most federal and private student loans do not have prepayment penalties, but it’s always wise to check your loan agreement or ask your servicer to confirm.

Should I pay off student loans early or invest extra money?

This depends on your loan interest rate compared to potential investment returns. If your loans have a low rate, investing may offer better long-term growth, but if peace of mind or higher loan interest is a concern, early repayment could be preferable.

Does early repayment affect my eligibility for loan forgiveness programs?

Yes, if you pay off your loans early, you will not qualify for forgiveness programs that require a set number of payments, such as Public Service Loan Forgiveness.

Can I make extra payments on my student loans whenever I want?

Most loan servicers allow extra payments at any time, but you should specify that the extra amount goes toward the principal to maximize your interest savings.